FY2023 BUDGET DEBATE ROUND-UP SPEECH BY DEPUTY PRIME MINISTER AND MINISTER FOR FINANCE, MR LAWRENCE WONG

A. Introduction

1. Mr Deputy Speaker, I thank all Members who have spoken and supported the Budget.

2. Many suggestions have been raised. I won’t be able to respond to all of them in this round-up speech. And some specific issues, for example, on education, energy, healthcare and workplace safety, will be discussed later in the Committee of Supply debates. But I assure you that we have heard every feedback, and we will study your suggestions carefully.

3. Sir, putting together the Budget has been a delicate balancing act of finding that sweet spot.

- a. We want to get back to a more sustainable fiscal position. But we cannot taper down support too quickly because the economic outlook remains uncertain.

- b. We want to help Singaporeans tackle cost-of-living pressures. But we must be careful not to inadvertently generate more demand and worsen inflation.

4. At the macro level, Budget 2023 is expansionary, not contractionary, contrary to what A/P Jamus Lim said yesterday. It is less expansionary than last year’s Budget because we are coming off from the high levels of spending, and that explains the negative fiscal impulse which he cited. But the Budget does provide some support for what it is likely to be a weaker economy this year, although we are careful not to overdo the spending in order to avoid fuelling inflation, which is something which Ms Foo Mee Har also cautioned.

5. At the same time, it is not possible for the Budget Statement to cover everything. In the end, we have to be clear about our priorities. And in this Budget Statement, we have focused on securing economic competitiveness, supporting families and vulnerable groups, and strengthening our resilience.

6. The questions raised by Members during the debate broadly revolve around three buckets of issues.

a. First, are we taking too much and giving back too little?

b. Second, are we doing enough to stay competitive and help our businesses and workers?

c. And third, are we doing enough to help Singaporeans and households in need?

7. I will address each in turn, and explain how we are updating our strategies for this changed world.

B. Are We Taking Too Much And Giving Back Too Little?

8. First, is the Government taking too much, and giving back too little? Do we have any fiscal slack? The short answer is “No”.

Extent of fiscal space

9. Mr Leong Mun Wai claimed that we have “excess fiscal resources”. The Government had spent $72 billion to fight COVID-19, of which $40 billion came from Past Reserves. So he inferred that we had $32 billion of spare resources lying around. But that is mistaken.

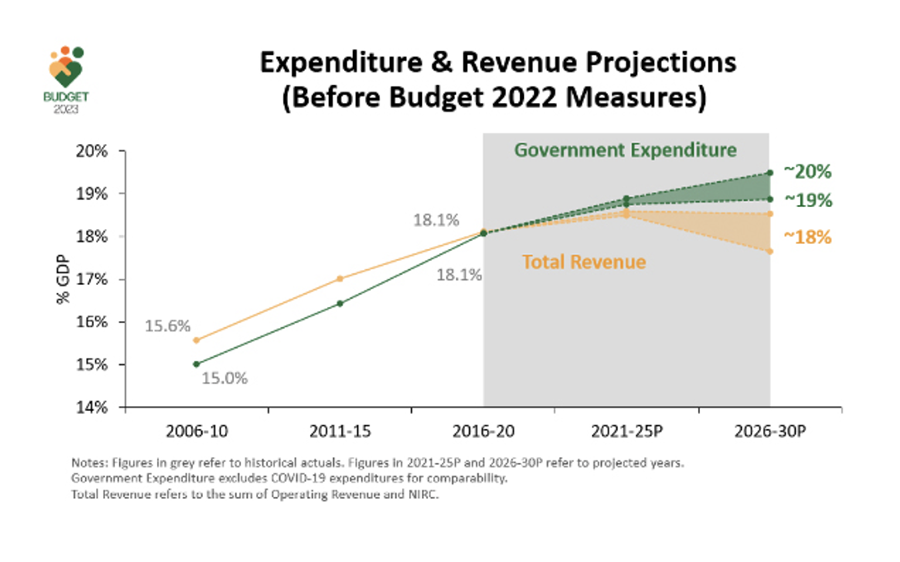

10. Let me explain. During the pandemic, our society and economy were in an entirely different state. Projects were deferred and many planned and budgeted activities could not be carried out. So the Government reallocated these resources towards the more urgent task of fighting COVID-19. Now that we are in DORSCON Green, these funds have to be channelled back to what they were originally meant for. So, there is no “slack” here.

11. Mr Leong also claimed that the $24 billion injected into Funds in FY2022 and FY2023 were “excess resources”, as the actual expenditure from these Funds would only occur in the future.

12. Again, this is not accurate. All spending in the Budget, be it direct expenses or top-ups to Funds, are resources we set aside to meet real needs – be it to strengthen safety nets, improve productivity, or build up critical infrastructure.

13. We set up Funds to meet specific funding commitments that are needed today, and are stretched out over multiple years. For example, the GST Voucher Fund and Progressive Wage Credit Scheme Fund require top-ups when we enhance the parameters of the underlying schemes, as we have done last year and in this Budget. The monies in these Funds are already being drawn down today, and not just in the future.

14. There are a few Funds where the disbursements are lumpy and not so predictable. For example, the outlays from the Changi Airport Development Fund for the development of Terminal 5 and other aviation facilities will be made in accordance with the progress of the infrastructure projects. And for such large and lumpy expenditure items, the responsible thing to do is to set aside some resources whenever we have the means, so that we smoothen out the spending and we do not end up in a crunch when the monies are needed.

15. From time to time, we do get some revenue upsides. This is what happened in FY2021 and FY2022 – our fiscal position turned out better than initially projected only because we were able to get through the pandemic in much better shape than we had earlier feared. We have put these additional resources to good use, channelling them to support Singaporean households and businesses. And that’s why, as Ms Foo Mee Har has noted, our expenditure in FY2022, including special transfers, was revised upwards.

Medium-term fiscal tightness

16. More importantly, as Mr Liang Eng Hwa highlighted, the right way to assess our fiscal position is to consider, not the year-to-year changes, but the broader medium-term trend.

17. And we have always been upfront and transparent about these fiscal projections, and continually review and enhance the information we put out. So as part of these efforts, MOF released an Occasional Paper earlier this month, and I am glad many Members referred to it and found it useful.

18. On the expenditure side, we expect Government spending that is now at 18% of GDP to reach 20% by 2030. In fact, even prior to the publication of the Occasional Paper, I had already highlighted this information. Here, I should emphasise the importance to look at our fiscal projections as a percentage of GDP, and not in nominal dollar terms, which Mr Leong had done. And he had suggested that we have been imprudent in our spending, because our expenditure now exceeds $100 billion compared to the pre-COVID levels of about $85 billion. “What a large increase”, he says. But surely, he must understand that nominal spending will increase with inflation and with a growing economy. In fact, between FY2019 and now, our spending remains at about the same proportion of GDP, which is around 18%. But looking ahead, with an ageing population and rising healthcare costs, we expect this to rise to around 20% of GDP by FY2030.

19. On the revenue side, without the GST increase and other tax moves we made in last year’s and this year’s Budgets, the projections clearly indicate that we would not have sufficient revenues to cover the increases in spending. And so, you can see the gap in this chart.

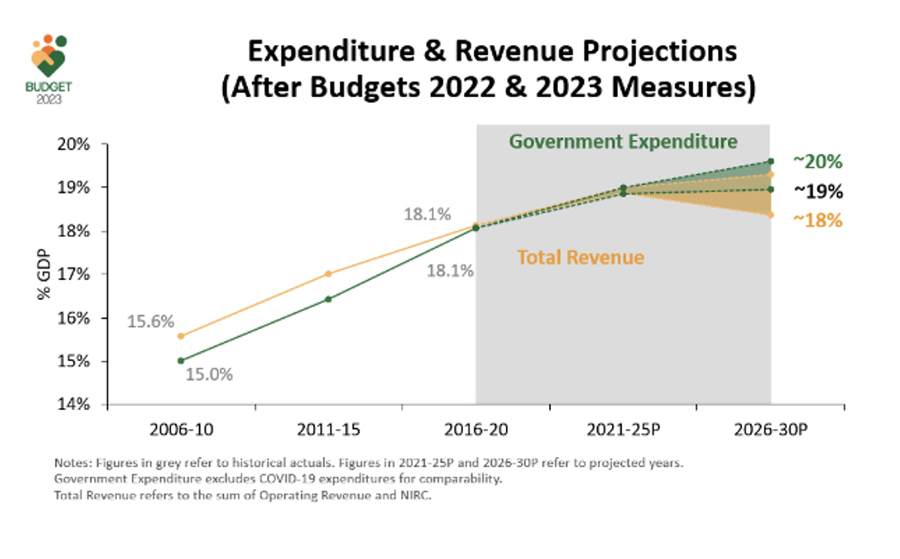

20. The revenue situation improves with the GST increase and the other tax changes made in last year’s Budget. And we’ve also updated the chart from what was in the Occasional Paper to take into consideration the tax changes in this year’s Budget. Combined, the revenue moves will help to close the funding gap.

21. But this assumes that we are able to keep our spending at 20% of GDP by the end of this decade. In fact, over the past decade, Government spending had risen by about three percentage points of GDP. And you can see it clearly from the chart – from around 15% to around 18% today. So, to keep it at 20% of GDP by the end of this decade would already demand some moderation in spending increase, compared to past trends, which we all know is not easy to do.

22. Furthermore, these projections have not taken into account additional spending that may arise from new policy initiatives. There may well be very good reasons for more Government intervention, some of which we are contemplating under the Forward Singapore exercise. And many Members in this House have also suggested new ideas. But all of that means additional spending, and all of this spending will need to be anchored by a fiscal plan that is sound, sustainable and fair.

23. So MOF will continue to monitor these revenue and expenditure trends closely. But, the bottom line is that our tight fiscal position is very much a reality over the medium term.

Second step of GST increase and other revenue options

24. That is why we have to proceed with the second step of the increase in GST in 2024 as planned. Deferring this will only store up more problems for the future, and will leave us with less resources to take care of our growing number of seniors.

25. And even as we increase the GST rates, we are also implementing and updating the GSTV to cushion the impact of the increase. Incidentally, A/P Lim said that the increase in the GSTV restores the Government’s original promise to offset the GST increase. I find this a rather disingenuous phrase, because it suggests that somehow the promise had been broken in the first place, which is factually incorrect. We have been very clear in the Government, consistently saying some Budgets ago when we talked about the GST increase, that the GST comes with the GSTV and the AP. The AP is intended to delay the impact of the GST by five years for the majority of Singaporean households, and ten years for the lower-income households. The GSTV is a permanent scheme, and it’s targeted at lower-income households and the elderly, and it’s meant to keep our overall system of taxes and transfers fair and progressive. All that was stated publicly, and we have also consistently said that we will update the parameters of both schemes to make sure that they remain relevant as economic conditions change. So this is not about restoring promises. This is about delivering on a promise that the Government had made, and this is what the PAP has consistently done and will continue to do.

26. What about other revenue options? We had discussed this extensively in this House. But let me address the various suggestions raised again, both in the run-up to the Budget and in the Debate.

27. First, wealth taxes. As many Members noted, we already tax wealth in Singapore through property tax, stamp duty, and motor vehicle-related taxes. And the taxes were raised in this and the last Budget.

28. The net wealth tax, which the Workers’ Party had previously suggested, is a specific form of wealth tax that taxes the net wealth of individuals. On paper, it sounds attractive. But in practice, it is very hard to implement effectively. Many jurisdictions have tried, but no one has done it well. This is why many countries have done away with net wealth taxes over the years.

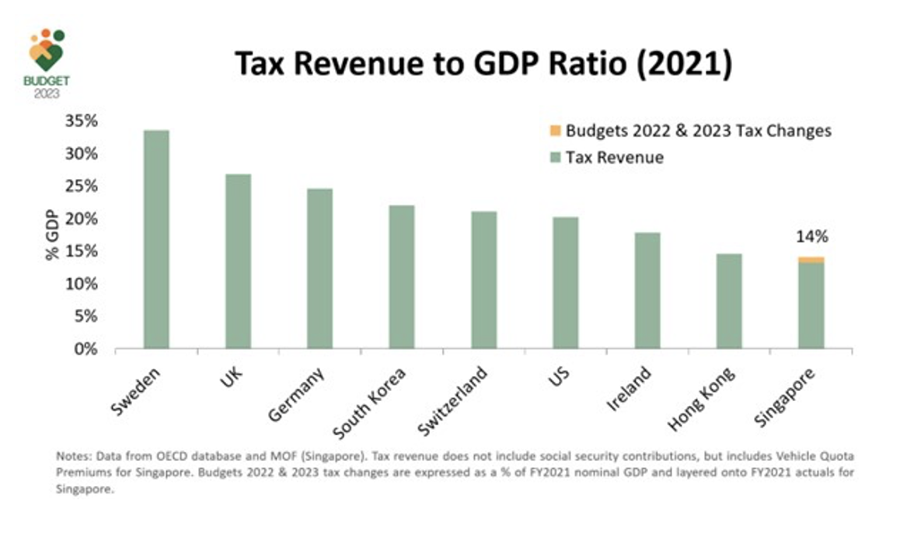

29. Even in Switzerland, which is often cited as a model, the reality is that the net wealth tax does not only target the very wealthy, who are able to avoid the tax through tax planning. And in the end, it is the middle-income and upper-middle-income groups who end up paying the net wealth tax. And the Swiss collect about 2% of GDP in revenues through wealth taxes. This is comparable to what we collect in wealth taxes from property tax and stamp duties.

30. Second, corporate tax, which several Members spoke about, including the impact of BEPS.

- a. Pillar 1 of BEPS re-allocates profits from where economic activities are conducted to where consumers are located. So given our small market size, Singapore will lose revenue under Pillar 1. I have mentioned this before. So that is something to bear in mind. BEPS has two pillars; we will lose revenues under Pillar 1.

- b. Pillar 2 effectively sets a global minimum effective tax rate. The intent of Pillar 2 is for large MNEs to pay more taxes, wherever they operate. So when Pillar 2 comes into play and Singapore implements the Domestic Top-Up Tax (DTT), we will get additional revenue, assuming the affected MNEs here do not leave.

31. But that’s a big assumption. Because the reality is, despite the professed intent of BEPS to tax MNEs more, countries are now rolling out vast subsidies to strengthen their competitive advantage over other countries, and to re-shore and on-shore activities. The US passed the CHIPS and Science Act and the Inflation Reduction Act last year. And the EU is now responding with its own scheme – the Green Deal Industrial Plan.

32. So, competition for global investments will only get tougher. We may not be able to outbid the major powers in spending. But we certainly cannot afford to stand still.

33. Contrary to what Mr Louis Chua thinks, the MNEs based here are not stuck with us permanently. They are mobile and they have options. And they will certainly have more options when they decide on where to locate their next investment projects. Within the region, there are many other places where land and electricity are cheaper, and wages are lower.

34. Sir, this is not just a hypothetical worry. The MNEs are already making this clear to us in our consultation sessions with them. Because of BEPS, they will no longer enjoy the same tax advantages in Singapore. Meanwhile, other countries in the region are cheaper, while their home countries are offering very generous incentive packages. So they ask us: what else can Singapore offer to stay competitive?

35. So when Mr Louis Chua and Ms Hazel Poa talk about raising taxes for MNEs, my response is: please be very careful; we cannot afford to price ourselves out of the competition, or else Singapore and Singaporeans will end up the biggest loser. In fact, as we move to align ourselves with the BEPS rules, we will have to review and update our broader suite of economic development schemes to stay competitive, as I’ve mentioned in the Budget Statement. That will require more funding resources, and that’s why MOF’s assessment is that the net fiscal impact of BEPS is unlikely to be favourable.

36. Third, land sales revenue. Now, this was discussed last year, and Ms Hazel Poa highlighted it again in her speech. She suggested that we spend from land sales proceeds by treating it as revenue divided over the period of the lease. So basically, under the proposal, the land sales revenues or proceeds will be spread out over the duration of the lease. In other words, if you have a 99-year parcel of land, you will get about 1% of the proceeds each year.

37. In fact, this alternative is not likely to generate more revenue than what we are already getting today from land sales over a period of time. Currently, when the State sells land, the financial proceeds go into Past Reserves, and are invested to generate a stream of income into our Budget through the NIRC. The effect is that we will be able to spend more than 1% of the proceeds each year, because the reserves are being prudently invested and generate long term returns, half of which we get to spend as revenue. And we believe this is a more sustainable way of deriving value from the land we own, through the NIRC that benefits us now and in the future.

38. I have gone through three alternative revenue options. But the fact remains that it is very hard for any of them to replace the GST. And given our growing needs, it’s not a matter of choosing between GST and any of these alternatives. Contrary to what the Workers’ Party believes, we will need all of them and a mix of taxes – on income, consumption and assets – to provide sound and stable public finances in Singapore.

39. Besides having a diversified revenue base, we also pay attention to the overall tax burden. And after factoring in the tax changes in Budgets 2022 and 2023, including the full GST increase, Singapore’s tax-to-GDP ratio is 14%. This is considerably lower than most other advanced economies as the chart illustrates. In other words, compared to citizens elsewhere, Singaporeans pay much less in taxes and yet are able to enjoy high-quality public services. At the same time, this low tax burden rewards hard work and enterprise, and allows our people and businesses to keep most of what they earn.

Fair and progressive fiscal system

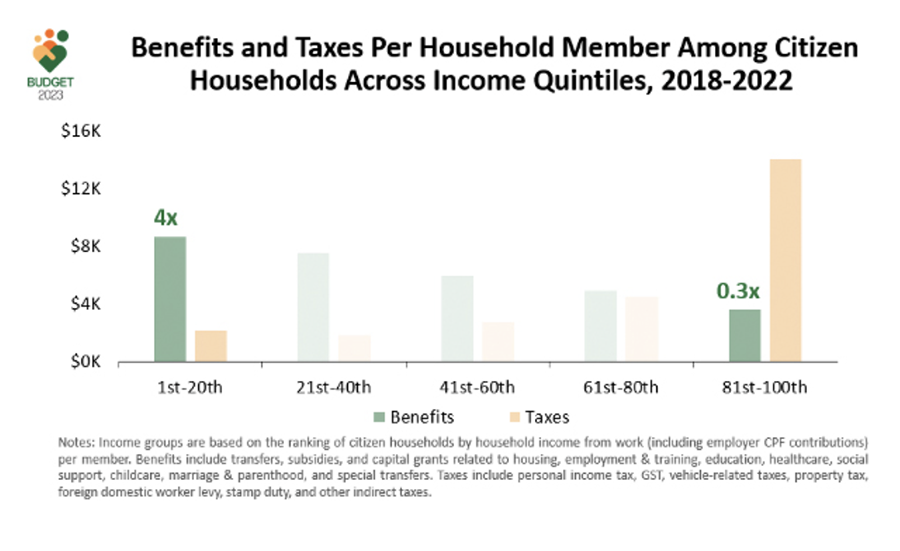

40. Aside from a low tax burden, some may ask: is the distribution fair and progressive? And here, our philosophy is that everyone has a part to play in building our nation. Everyone contributes, but those who are better off contribute more. Everyone benefits from Government spending, but those with greater needs benefit more. We believe this is what makes for a fair and inclusive social compact.

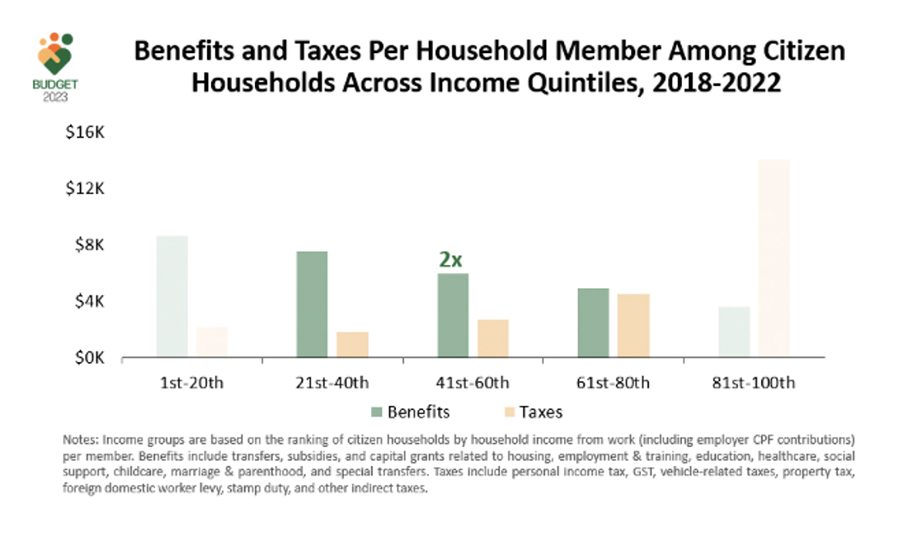

41. The outcomes are evident when you look at the benefits and taxes across different income groups. The top 20% bear the heaviest burden in taxes, and receive the least in benefits. In recent years, for every dollar they paid in taxes, they received only about 30 cents in benefits.

42. Conversely, the bottom 20% paid the least in taxes, and received the most in benefits. For every dollar they paid in taxes, they received around four dollars in benefits.

43. What about the middle-income groups? Several Members, including the Leader of the Opposition Mr Pritam Singh, Mr Xie Yao Quan and Ms Nadia Samdin and many others shared concerns of this group. I assure you that the Government remains very focused on advancing the well-being of the broad middle of society.

44. How do we achieve this?

45. First, by ensuring that they continue to enjoy real income growth. In fact, among the advanced economies, we are one of the few where people in the middle have enjoyed significant increases in real incomes in the last 20 years. Median household real income per household member growth in Singapore over the last decade was more than 3% per annum. It’s higher than what the middle-income in the US and most other European societies experienced, and well above other Asian societies like Japan and Hong Kong. So we will continue to do everything we can to help our broad middle raise their standards of living, and support them in meeting their aspirations.

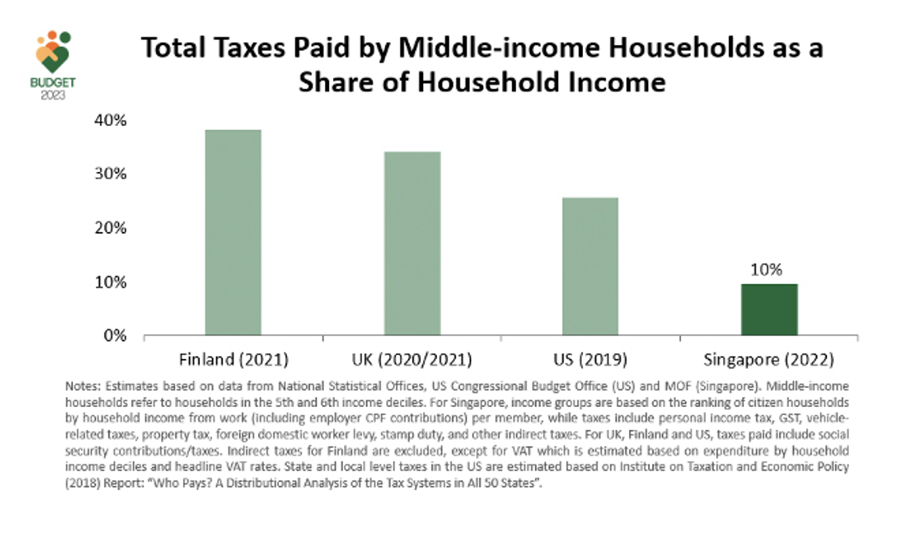

46. Second, by keeping the tax burden low for this group. I’ve shared earlier the low overall tax burden for Singapore. That was expressed as a percentage of GDP, as a percentage of our economy. But you can translate that into households, and when you look at households in the middle quintile and the total taxes paid – total taxes, not just personal income tax, but other indirect taxes as well – the effective tax burden is around 10% of income.

47. How does this compare to other advanced economies? My team did some estimates for the US, UK, and Finland based on publicly available data. Not all data are complete, but the estimates give a broad sense. And they clearly show that our tax burden is significantly lower than that of these countries. In his speech, Mr Leong said that the middle-income in Singapore are, I quote, “already over-taxed relative to their income”. I think the facts and figures speak for themselves. What Mr Leong said is an outright falsehood.

48. Several Members, including Ms Jessica Tan, Mr Louis Chua, Mr Dennis Tan, and Ms Hany Soh, were concerned about the impact of the changes to the Working Mother’s Child Relief (WMCR) on the middle-income groups.

49. And Sir let me clarify this: when the WMCR was introduced, it was intended to encourage married women, and especially higher-income married women, to have children and continue working. At that time, higher-income married women had fewer children on average. And that’s why the incentive was weighted toward this income bracket. But from our experience over the years, young couples in this income group typically base their decisions to have children on other factors, and not so much on the WMCR incentive. Furthermore, the situation has now changed. Fertility has been declining across all income segments, and we need to encourage couples in all income groups to have more children.

50. That’s why we decided to change the basis of the WMCR. With the fixed dollar relief, we focus instead on providing support for children, regardless of the mother’s income. And effectively, we are tilting the help towards those with greater needs. Importantly, the WMCR changes should not be seen in isolation. They are part of a package of moves to support marriage and parenthood in this and previous Budgets. That includes the enhancements to the Baby Bonus Scheme, and the increase in parental leave provisions, all of which will benefit young couples, including higher-income couples, as they embark on their parenthood journey.

51. This brings me to the third point about what we do for the middle-income. Because we really shouldn’t just look at the individual schemes and changes to the individual schemes, but we should focus on the overall taxes and benefits for the middle-income. Here again, it is clear that the middle-income overall still receive more in benefits than the taxes they pay. In particular, for the middle 20%, the amount of benefits they received was about twice the amount they paid in taxes. This compares favourably with other jurisdictions, like the UK and Finland, where the middle quintile received around $1.25 of benefits for every dollar of tax they paid -- 1.25 to 1 -- whereas our ratio is 2 to 1.

52. This is for the middle quintile. But some say, well, the middle-income group is very broad, but you can look at the slides. Even the upper-middle-income groups (those in the 61st to 80th percentile) received about the same or slightly more in benefits compared to what they paid in taxes. They may not get as much in direct cash benefits compared to the lower-income groups, but they enjoy access to affordable housing, healthcare, and world-class education.

53. Of course, in every Budget Debate, comparisons will be about made about why some groups get something, and others appear to be left out. For example, over the last two days, we’ve heard Members like Ms He Ting Ru and Ms Shahira Abdullah, asking about benefits for singles and single parents. I understand their concerns.

- a. But we should not look at the Budget Statement in isolation.

- b. In fact, the entire Budget itself provides for all groups. There are many existing schemes not highlighted in the Statement per se, but are part of the Budget, which everyone benefits from.

- c. And as the charts I have shown demonstrate, our system is fair, inclusive, and progressive.

- d. At the same time, we review all our schemes from time to time to ensure they remain relevant. So we enhanced our parenthood and family-related schemes in this Budget. Next time, we will look at other schemes. So everyone will get a chance.

54. Mr Deputy Speaker, this is how we’ve designed our system. It reflects our values and our sense of solidarity as a people. We encourage and support everyone to excel, and be the best that they can be. We create and maximise opportunities for all. But we recognise that outcomes in life will not be equal. So for those who are fortunate to do well and be in the top 20%, we hope they will feel that sense of commitment and responsibility to contribute their fair share, and help uplift their fellow Singaporeans.

55. This compact goes beyond monetary support. Because everyone in Singapore, everyone including the higher-income, benefit from something very precious here in our society – we are a high trust society, stable and harmonious, with strong governance and rule of law.

a. And this gives all Singaporeans the safety and security to raise our families, build our lives, and pursue our dreams.

b. This sense of solidarity and trust is what makes Singapore exceptional. And that’s why, through the Forward Singapore exercise, we are refreshing our social compact, so that it remains strong and relevant amidst a rapidly changing world.

C. Are We Doing Enough To Stay Competitive And Help Businesses And Workers?

Staying competitive and growing the economy

56. Let me move on to the second bucket of issues around the economy, and whether we are staying competitive and helping businesses and workers sufficiently. Many Members spoke on this theme, including Mr Liang Eng Hwa, Mr Sitoh Yih Pin, Ms Foo Mee Har, Mr Sharael Taha, and Mr Vikram Nair.

57. Mr Edward Chia and Mr Derrick Goh also highlighted sentiments from the business community where some have wondered, has the Government changed, has the PAP Government changed? Have we moved from a “pro-growth” to a “pro-redistribution” approach?

58. Let me set the record straight. We remain focused on growing the economic pie. Because only then can Singaporeans build better lives for themselves and their families. Only then will we have the resources we need to redistribute, strengthen our social compact, and progress as one people.

59. Pursuing growth will not be easy amidst a more challenging external environment – I mentioned that just now. Competition and geopolitical tensions will continue to rise as the major powers race for the commanding heights of the global economy.

60. Singapore has to adapt to this new era. And the good news is we are moving forward from a position of strength. We are seeing healthy flows of investments, capital, and talent into Singapore. And we are seizing these opportunities to build capabilities, strengthen our value proposition, and ultimately create more jobs and opportunities for Singaporeans.

61. We must build on our strong foundations and leverage our competitive advantages fully, while managing our inherent and permanent constraints, especially in the areas of manpower, land, and energy. We will always be a “little red dot”. Manpower resources will always be insufficient, land will always be limited, and we will always be energy-constrained. And so we cannot compete on the basis of cost alone. Instead, we must focus on differentiating ourselves in terms of quality and value.

62. For example, we are not the lowest-cost seaport in the region, or the world. Yet, shipping companies prefer for their goods to transit and tranship through Singapore, because of our good connectivity, robust port infrastructure, and comprehensive range of maritime services. Our port is highly efficient, containers don’t get lost, shipments are cleared promptly and reliably without shippers having to make any special or informal arrangements. This is just one example of how we differentiate ourselves.

63. But clearly, given the more challenging external environment, we must redouble our efforts to raise our game. We must build more capabilities, and we certainly cannot score own goals, do moves that will price ourselves out. We must work hard to be more competitive and anchor more quality investments. And that’s why we are setting aside additional resources and expanding the scope of the National Productivity Fund.

64. Because having more high-quality investments here will help grow our economy and create more jobs for Singaporeans. This will also benefit our local ecosystem, especially through the transfer of technological know-how and expertise to our SMEs.

65. Take the example of our medtech sector. We have built this up over the years, anchored by MNEs like Waters Corporation, Illumina, and ResMed. These companies have brought cutting-edge capabilities to Singapore through their investments. Over the years, they have sunk roots here and contributed to the growth of our medtech ecosystem. They have developed strong partnerships with local companies like Richport, Nanofilm, and Sunningdale, enabling our local enterprises to improve their capabilities and scale up their businesses to reach out to more customers.

Growing productive and capable local enterprises

66. At the same time, we are continuing to put in significant resources to nurture and grow our local enterprises, especially our SMEs.

67. In fact, the amount of support extended to SMEs through capability building grants like the Productivity Solutions Grant, the Enterprise Development Grant, and the Market Readiness Assistance Grant doubled between 2019 and 2022. The number of Singapore enterprises that we supported to build new capabilities, innovate, and expand overseas increased by about 60% over this period. The additional schemes introduced in this Budget demonstrate our continued commitment to supporting our SMEs.

68. Several Members like Mr Seah Kian Peng and Ms Janet Ang highlighted the challenges that SMEs face amidst rising business costs. We understand, there are challenges. And in this Budget, we have rolled out some measures to help businesses with some of their immediate cost pressures. This includes the Government taking on a major share, 75%, of the cost of wage increases under the Progressive Wage Credit Scheme.

69. But the main thrust of our support for SMEs is focused on helping those who are prepared to take steps themselves to restructure their businesses, raise their productivity, and venture into new markets and products. Because, as Prof Hoon Hian Teck said, this is the only way for enterprises to survive and thrive on a sustained basis.

70. We take a sectoral approach through the Industry Transformation Maps to help our economy restructure and transform, because the circumstances, needs, and starting points of each industry are very different. And several Members like Mr Pritam Singh and Ms Cheryl Chan spoke about this. Overall, we have made good progress in this transformation journey. In particular, outward-oriented sectors like manufacturing and financial services have achieved strong productivity growth and job creation.

71. But as Ms Poh Li San and Mr Leon Perera highlighted, the domestically-oriented sectors like construction, retail, and F&B face more challenges. This is not unique to Singapore at all. All countries face similar challenges. In these sectors, they will need to adopt structural solutions to increase productivity and grow sustainably. But there are some encouraging signs.

- a. In the construction sector for example, more firms are moving towards Design for Manufacturing and Assembly, which includes using prefab modules and units.

- b. In the F&B sector, we have seen more companies with multiple outlets adopt central kitchens to automate and streamline their operations, and take advantage of economies of scale.

- c. These and other strategies will help such sectors raise their productivity, and reduce their reliance on manpower.

72. So overall, we have made progress, but we still need to go further. And that’s why we will press ahead with our work on industry transformation, and we also hope to see more companies making full use of the schemes available to restructure and transform.

73. Even as we press on with productivity improvements, we also have to gear up for the green transition and the decarbonisation of our economy. And several Members including Ms Carrie Tan, Dr Lim Wee Kiak and Prof Koh Lian Pin spoke passionately about this.

74. There is clearly much more we will need to do prepare businesses, workers, and our economy for this green transition. I announced several significant moves in last year’s Budget, including our net zero target and the carbon tax trajectory. Many of these moves are a work in progress. The Minister for Trade and Industry will be happy to share more, I’m sure, at the Committee of Supply.

75. Mr Derrick Goh and Mr Don Wee also shared that the application process for grants is sometimes cumbersome for SMEs, and disbursements can take a long time.

a. We hear these concerns. Our economic agencies will continue to work closely with companies to support them through the different stages of growth. For example, SMEs can tap on the GoBusiness portal which offers convenient cross-agency access to over 100 Government assistance schemes.

b. In processing applications and claims, we strive to be as efficient as possible, while ensuring accountability and safeguarding the integrity of the system. So I hope Members understand this need to balance speed with the need for accountability in the use of public monies.

c. But we certainly welcome further feedback, we will look into your suggestions, and our agencies will continue to streamline and improve processes.

Equipping our workers

76. As we grow the economy, we will also ensure that the growth translates into better jobs and opportunities for our workers.

77. In a dynamic and vibrant economy, we must expect a continual refreshing and updating of jobs. Unproductive jobs will become obsolete, and new, better, more productive roles will be created in their place. These new jobs could be within the same companies and sectors as where the unproductive jobs are eliminated. They could also be offered by more successful and expanding employers in the same sector, or in other sectors altogether, that grow to take the place of the declining ones.

78. This churn is an integral part of healthy economic growth. But it does create uncertainty for workers. Because workers will need to re-skill and upskill to stay relevant and take on new roles, be it in the same company, or in a different company, or even in a different industry altogether. That is why we are investing significantly in skills and human capital, to help our workers progress in their careers and earn better wages.

79. We started this journey with – in fact, it’s been an ongoing journey – but we made a further push with the SkillsFuture movement in 2015. We have made progress since then.

- a. At the individual level – through SkillsFuture, we have empowered individuals to take charge of their own skills development, and created a culture of lifelong learning, which is growing.

- b. Amongst our institutes of higher learning (IHLs), we have brought about a major mindset and paradigm change. Our universities, Polytechnics, and ITE no longer just focus on pre-employment training, but they are now firmly embedded in the continuing education and training space.

- c. At the employer level, we have also made progress. In the past, when you asked employers about competencies and skills that their workers need, you probably might not get a clear response. Now, through efforts like NTUC’s Company Training Committees, employers and unions are coming together to focus on job redesign and training.

80. Yesterday, many Labour MPs spoke passionately about this, and you can hear from the speeches that we have come a long way. But we will do more. The Jobs-Skills Integrators is the next move to strengthen the training and placement ecosystem for our workers. Actually, the role that the integrator plays is not new. We have always recognised the need for such an entity – it could be a training provider, a company, or an industry association – but there is always a need for such an entity to act as a coordinator, and bring together the various stakeholders in a particular sector. Up to now, this integrator role has been done in perhaps a more ad-hoc fashion. But we’ve studied the experience of other countries like Sweden and Switzerland, which have formalised such a role, and seen some positive outcomes.

81. That’s why we decided to pilot the Jobs-Skills Integrators in three sectors for a start, and we’ve chosen sectors where there are more SMEs, and more mature workers. We hope that with additional Government resourcing for this new formalised role, and very clear outcome indicators and KPIs, we can achieve better quality training and job matches.

82. I appreciate the strong interest in the Jobs-Skills Integrators. We are only at the start of this initiative, and there is still much more to be done. The Minister for Education will share more at the Committee of Supply.

83. Several Members – Mr Patrick Tay, Ms Mariam Jaafar and A/P Lim – spoke about the challenges that mature workers will face, especially if they are displaced or retrenched, and I agree with them.

a. Younger workers in their 20s will often be able to get back to work quickly, particularly in the current tight labour market, where there are still high vacancy rates and job openings.

b. But if you are in your 40s and 50s, and are displaced or retrenched, it is harder to find a job.

c. At that age, many will also have heavier family responsibilities – to their young children, ageing parents, or both.

d. So they find it difficult to go for more extensive training, especially to switch to a new growth area. Instead, many would just take the first job available, even if it is not such a good fit for them.

84. And that’s why we are studying how we can better support our displaced and mature workers through these challenging transitions and setbacks.

a. I hope Members appreciate that we have to think through and design these moves carefully. We have to ensure that whatever we do does not erode the incentive to work.

b. And this is again not theoretical, because we’ve seen the results of unemployment benefits offered in other places, where displaced workers receive generous benefits, but they then find it more attractive to stay unemployed than to get back into the workforce.

c. We want to avoid these negative outcomes. So, what we really should be thinking about is more like targeted re-employment support.

d. We want to provide some cushion while the workers undertake training to upgrade their skills, and take on new roles that better fit their abilities and aptitudes.

e. And ultimately, we want to help Singaporeans bounce back stronger from any setback that they may encounter throughout their careers.

85. So we will consider this and other moves to strengthen our SkillsFuture ecosystem. And we are, in fact, deliberating and looking at this very carefully. Because our workers will always be at the heart of our economic strategies. And when workers across the whole economy find their work meaningful, the result will be higher job satisfaction, greater fulfilment, and a boost to productivity.

86. Members in this House, I’m sure, will remember that it was not so long ago when the Government was being criticised for pursuing a “growth at all costs” strategy – that we were chasing economic growth at the expense of Singaporeans. I think Ms Carrie Tan and Ms Nadia Samdin, to some extent, echoed some of these sentiments in their speeches, when they talked about adopting different models of success that are not just driven by a single-minded pursuit of growth.

87. At the same time, now that growth is slower, we are in a different situation. Many Members in this House now are concerned that we are not sufficiently focused on growth. That if we are faced with a shrinking pie, contentious disputes over how to distribute limited resources will be inevitable, which can be very socially divisive, as we have seen in many other countries.

88.But Sir, in fact, we have always taken a balanced approach in our economic development and strategies. Our focus has always been to grow the economy, not for its own sake, but as a means to improving the well-being and lives of everyone in Singapore.

a. And in all that we do, we work closely with our tripartite partners. As SMS Heng Chee How, MOS Desmond Tan, the Labour MPs, and Mr Raj Joshua Thomas highlighted, tripartism is the competitive advantage that sets Singapore apart, and distinguishes us from other countries. Our model of tripartism has been the bedrock for Singapore’s growth and prosperity. And it has been critical in enabling us to rebuild from crises, and to emerge stronger.

b. So in Singapore, it’s not about “pro-business” vs “pro-workers”; neither is it about “pro-growth” vs “pro-redistribution”.

c. It is about all of us – employers, unions, and the Government – coming together, working together to advance the well-being of Singaporeans, and build a better future for ourselves and our children.

D. Are We Doing Enough To Help Singaporeans And Households In Need?

Addressing cost-of-living pressures

89. The third broad bucket of issues is about whether we are doing enough to help Singaporeans and households in need. And indeed, many Members spoke up in this area, and supported the Government’s efforts to help Singaporeans.

90. Cost-of-living is a key concern for many. That’s why we have provided comprehensive measures to help Singaporeans cope with cost-of-living pressures.

- a. Our focus is on the lower-income groups.

- b. But the help extends to sandwiched and middle-income families too, like those whom Mr Xie Yao Quan, Mr Abdul Samad, and Mr Mohd Fahmi Aliman were concerned about.

- c. That’s why we have designed our package to provide more help for larger families, who have young and elderly dependants.

- d. We will continue to review our social support schemes and their means-testing criteria, taking on board all your suggestions, including the Annual Value (AV) thresholds, to ensure that Singaporeans in need receive the support that they need.

91. I am also heartened by the efforts of the Consumers Association of Singapore like Price Kaki which Mr Melvin Yong spoke about, and we will consider and look into his suggestions as well, and that companies like NTUC FairPrice and Sheng Siong are doing their part to help cushion the impact of higher prices.

92. Another topic that many Members spoke about is housing affordability. We debated this at length earlier this month. I wasn’t going to touch on it originally, but since so many of you spoke about this, I thought I should cover it briefly in my remarks.

93. We are all concerned about the affordability and accessibility of public housing in Singapore. But I think it’s important we understand the underlying causes for the challenges we face today. Because failure to diagnose the problem properly can lead to the wrong solutions.

94. I say this with some perspective because I was in MND during the period when HDB resale prices came tumbling down. They fell for six consecutive years from 2013 to 2019. Mr Desmond Lee is in the hot seat now; I was in the hot seat then for a different reason. And at that time, we used the same methodology to price BTO flats then, as we are doing now. But when resale prices were falling, no one seemed to be unduly concerned about the prices of new flats. On the contrary, there was a great anxiety that there would be a huge overhang of flats, and we would end up with a price meltdown.

95. And that’s precisely why the Workers’ Party proposed in 2019 to cut back the annual BTO supply to just 9,000 flats. I read the letter published in the Straits Times today. The Workers’ Party now says it wasn’t a proposal. Well, come on. You can call it whatever you want. But it was quite clear in the Working Paper, in a section headlined, “Calibrating the construction of new BTO estates”, it says very clearly, “around 9,000 or so dwelling units are required annually” based on various population parameters, otherwise HDB will have a vacancy rate problem. Fortunately, HDB did not take their advice. That was up to 2019.

96. Then how did the situation change so quickly in the last three years? We had a pandemic that disrupted our BTO building programme, and when that supply was disrupted, and waiting times became longer, people felt anxious and more started applying for BTO flats earlier. Others decided to get a resale flat instead, because waiting time was so long; so that drives up resale demand. So, we had a confluence of both delayed project delivery and increased demand, contributing to the situation that we are in now.

97. Who could have anticipated and predicted all this? Really? Indeed, if we had adopted the WP proposal, well never mind, heeded their advice, since you don’t want to call it a proposal. And if we had done so, and cut back the building of new flats, and their subsequent proposal to allow singles aged below 35 to buy new flats, we would be facing a much bigger supply-demand imbalance today. So, you know, let’s all show some humility in this. What happened could not have been predicted and let’s refrain from passing judgment with the benefit of hindsight.

98. Under the current circumstances, the Workers’ Party now says that the house price-to-income ratio should be lowered to three. Well, actually, why stop at three? Why not make it two, or even one? Regardless of the number, more funding will be required to make new flats cheaper. No one disputes that. Someone has to pay.

99. But I think the Workers’ Party doesn’t want to talk about increasing subsidies and making the taxpayer cough out more. So they have chosen instead to go with what they think is a, probably, a more expedient and seemingly painless option – which is to dip into the reserves by selling the State Land to HDB at a lower cost.

100. But, we must remember that public housing land is sold directly to HDB at a fair market value determined by the Chief Valuer using established and accepted valuation principles. What would be the basis for the Government to get the Chief Valuer to change the valuation method? In fact, it is precisely because we don’t want the Government to influence the Chief Valuer’s decisions that we have safeguarded the post of the Chief Valuer in the Constitution, and made the appointment and removal of the post subject to the President’s veto.

101. Pritam Singh alluded to, in his question, that there is a discrepancy because State Land sold under the Government Land Sales (GLS) programme can potentially enjoy a 15% discount. But that’s a red herring.

a. The fair market value of State Land sold through an open tender, such as under the GLS programme, is determined through price discovery when developers bid for the land.

b. We set a reserve price for these tenders. It is at 85% of an estimatedmarket value as determined by the Chief Valuer. But that’s a reserve price, not a discount.

c. And this reserve price serves as a guidepost for the Government to assess the bids that are received before awarding the tender. For example, if the highest tendered price is below this 85% threshold, we might want to check this against other factors, like the prevailing market conditions, the number of independent bids received, and the specific circumstances about the site.

d. So it’s a guidepost for us to do our checks. And if we are convinced that the bids are competitive and reflect actual market conditions, because it went through a tender process, then we would still proceed with the highest acceptable bid in the tender, because that is the fair market value of the land.

102. Public housing land is not sold through an open tender like the GLS programme because there is only one developer – the HDB. But HDB flats are purchased and sold all the time in the open market. There is a well-established open market value for the flats, and therefore working backwards, one can calculate the value of the land used to build HDB flats. These transactions provide the Chief Valuer with up-to-date market data to consider when making his or her independent determination of the fair market value of public housing land. These valuations are based on objective facts. They are not an arbitrary subjective opinion. It is also real, as every HDB homeowner knows, who has sold his flat for more than he paid HDB, and used the capital gain to upgrade to a bigger flat, or to put aside for their retirement needs.

103. The bottom line is you cannot just change the way land is priced to bring down the selling price of flats. And if you were to try to artificially “reset” the housing market in this manner, you will risk destabilising the entire property market.

104. Actually, Associate Professor Lim recognised this in his Facebook post two days ago. He said that with the proposal by the Workers’ Party to reduce the land price, some homeowners who have bought their flats under current terms and subsequently wish to sell their flat for various reasons, quote, “may go underwater” or quote, “have to stomach a loss”. Is this what the Workers’ Party wants to do – to arbitrarily wipe out a significant chunk of the value of Singaporeans’ hard-earned properties?

105. But at least Associate Professor Lim acknowledged this problem. Because Mr Leong Mun Wai, who similarly wants HDB BTO prices to be drastically reduced, has claimed that this proposal has no impact on the resale market, and Singaporeans can have their cake and eat it too – cheap BTO prices, high resale prices, home buyers still enjoying enormous capital gains, and the Government doesn’t have to do anything. It seems like magic, but it is really a raid on the reserves.

106. Suffice to say, there are no magic solutions to solve the current housing issues. The Government’s approach, and what we believe is the right thing to do, is to tackle the root cause of the problem. What is the root cause? It is supply! So, let’s ramp up BTO supply, catch up with the delays that had arisen over the COVID-19 period. HDB is doing the best it can, and MOF is supporting them with the resources to do so. And I am confident that we will, through all these efforts, get things back on track soon.

107. Now there’s also a view being put out by some Members, I think Ms Hazel Poa and others highlighted, the Government’s policy on land value is driving up public housing prices, that leads to continued increases in subsidies for BTO flats, which may not be sustainable. But now, again, we are looking at this now, and the concern arises, because of the current cyclical tightness in the public housing market. The situation will be different once the market stabilises. Or if you have a down market. So, rather than look at the ups and downs cyclically, the fact is, land value will ultimately be based on economic fundamentals.

108. Meanwhile, because it will take time for the supply to go up, we have made some moves in this Budget to manage demand. In particular, we are giving greater priority to families with children and married couples aged 40 and below, who are buying their first home and the additional ballot will significantly increase their chances of securing a BTO flat, especially one in a non-mature estate.

109. And we are increasing the CPF Housing Grant for resale flats, so that eligible First-Timer families and singles with more urgent needs can purchase a resale flat.

a. I know quite a number of Members have highlighted concerns that this increased grant will cause sellers to ask for higher resale prices, and may not work. I understand the concerns.

b. And in fact, there will always be a risk like this when we increase the grants.

c. And that’s why we considered it very carefully, and we took into account the property cooling measures we had implemented, and HDB’s progress in ramping up BTO supply, before we decided on this move.

d. Furthermore, not all flat buyers will benefit from the increased grant. Based on the data on resale transactions over the last two years, only about one-third of resale flat buyers received the CPF Housing Grant. So, while the enhanced grant may have some impact on resale prices, overall, First-Timers should benefit from the grant and pay less when they buy a resale flat. That is the intent.

e. This is a targeted support measure, rather than a broad-based move; and we are confident that it will help First-Timer families and singles buying in the resale market, and indirectly also reduce some of the demand for BTO flats.

110. Now there’s certainly a lot more we can cover on housing. This is not a housing debate, this is a Budget Debate. So I’ve focused on the key points, especially where it relates to land and reserves matters. But I’m sure there will be more to discuss, and the Minister for National Development will address them at the COS.

Tackling inequality and social mobility

111. Many Members including Dr Wan Rizal, Mr Desmond Choo, Mr Leon Perera, and Mr Christopher de Souza also spoke about what more we can do to tackle the related issues of inequality and social mobility.

112. As I highlighted in my Budget Statement, our moves to uplift lower-wage workers through Workfare and Progressive Wages are showing results. Over the past five years, our lower-wage workers have consistently seen higher income growth than those at the median.

113. So we will continue with our efforts to uplift the incomes of lower-wage workers. Last September, we expanded the Progressive Wage Model, or PWM, to workers in the retail sector. Next month, workers in food services, as well as administrators and drivers will come on board. Come July, we will cover workers in waste management. And taken together, our Progressive Wage approach covers the vast majority of lower-wage workers. So the moves we are making will have a positive impact in uplifting their salaries over the coming years.

114. Beyond these PWM sectors, we are charting out skills-based career ladders for tradesmen in key essential services like plumbers, electricians and aircon mechanics. Earlier this month, the Labour Movement mooted the Career Progression Model, a new framework which will uplift the work prospects and wages of skilled essential tradesmen, and professionalise these trades, and the Government will support the Labour movement in these efforts.

115. We are also focusing on new entrants to the workforce, especially our ITE graduates whom Mr Desmond Choo and others spoke about. We are equipping them with industry-relevant skills and a strong foundation for future learning. In fact, through programmes like the Work-Study and Technical Diplomas, ITE graduates are seeing better employment outcomes, with median starting salaries that are comparable to those of Polytechnic diploma graduates. So these are positive indications, and we will continue to do more.

116. The Government will do our part, but we will not be able to narrow wage gaps on our own. As many Members highlighted, to ensure sustainable growth in real wages for our lower-wage workers, Singaporeans need to chip in too.

- a. As consumers, all of us must be prepared to pay more for services delivered by our fellow Singaporeans – be it cleaning of our housing estates, air-conditioner servicing, security, or retail.

- b. But most importantly, we must treat everyone with dignity and respect, and value everyone for the work they do.

- c. And that’s why we join our Brothers and Sisters in the NTUC to affirm that “Every Worker Matters”. This is not just a slogan; it is a fundamental tenet undergirding our entire approach of nation building.

117. Besides dealing with inequality, we must ensure that social mobility remains alive and well in Singapore. We have done better in this aspect than many other advanced economies. But any society which has been stable for a long time tends to stratify, and that’s why we must collectively lean against this tendency, and do more to uplift disadvantaged groups.

118. Here, support in the early years matters critically. And that is why we have been making significant shifts on early childhood over the past few years, and will do more to narrow the preschool enrolment gap between children from lower-income households and their peers.

119. We are also helping lower-income families tackle the complex and multi-faceted challenges they face holistically and through better coordination, which I spoke about in the Budget.

120. Today we have different Government agencies overseeing various schemes – HDB has the Fresh Start Housing Scheme, MOE has its UPLIFT Initiative, ECDA has KidSTART, and so on. But in the end, our approach cannot be scheme-centric; it must be family-centric. That’s why we are streamlining common functions such as outreach, befriending, and case support under ComLink to serve the 14,000 families with children living in rental housing.

121. The officers engaging these families take a different approach. They do not just promote specific Government schemes. Their starting point is the needs of the families – to find out their concerns, and what we can do to support them, such as helping them secure a better job, or ensuring that their children attend school regularly or have a conducive environment to study in.

122. We are seeing many success stories of families being uplifted through this approach, where families receive customised support to help them stay on track in their progress. It requires much more work and effort on the part of our officers; it also requires us to work closely with social workers and community partners on the ground. But ultimately, it is the best way to encourage and empower families to achieve success and to sustain their progress.

123. Tackling inequality and sustaining social mobility is really about making our system of meritocracy work well for all Singaporeans. And in fact, we’ve long recognised the problems with an “unbridled” and “winner-takes-all meritocracy”, which Mr Leon Perera spoke about. That’s why we set out to achieve a more open and inclusive meritocracy over a decade ago. So I am glad that Mr Perera agrees with and supports the Government’s objectives.

a. In fact, Members would have seen the many moves we have made towards these objectives over the years – from the earliest years of life to our efforts in schools and the labour market.

b. We are not done yet, and we are actively working on all fronts to minimise social barriers and encourage mobility – because this is what Singapore has always been about, and must continue to be.

c. And we remain open to all good ideas. We are pragmatic, and we are also realistic. This is not about pursuing the latest fads in policy thinking. It is about what works, and what is effective in bringing us closer to our goals.

Supporting our Seniors

124. Another group that we are focusing on is our growing number of seniors. Many Members spoke about this, including Ms Jessica Tan, Mr Yip Hon Weng, SMS Heng Chee How, Mr Dennis Tan, Mr Sharael Taha, Mr Henry Kwek, Mr Saktiandi Supaat, Ms Tin Pei Ling, and Ms Ng Ling Ling. They covered many areas including employment, retirement adequacy, and care options. So let me touch on these briefly.

125. We all know that as our population ages, our healthcare needs and costs will increase, and the strains on our families and caregivers will grow. We have been making moves in Budgets in recent years to take better care of our seniors. For example, seniors will receive significant benefits under the enhanced Assurance Package and GST Voucher scheme.

126. Besides providing near-term support, we want to help our seniors live healthily and independently for as long as possible. And I also agree with Members that those who wish to continue working should be well supported to do so.

- a. That’s why the Government is progressively raising the retirement and re-employment ages, and providing substantial employment support for seniors.

- b. Over the past five years, we have seen an overall improvement in the employment rate of senior workers, and we will continue to push for further improvements, working together with our tripartite partners.

127. As part of the refreshed Action Plan for Successful Ageing, we are also stepping up efforts to help our seniors remain socially active in the community.

128. And when our seniors retire, we want them to have enough to enjoy their silver years. And that’s why we have been working hard to boost the retirement adequacy of different cohorts and segments. It is the reason why we are progressively raising the CPF monthly salary ceiling. The increase is intended to keep pace with the 80th percentile of monthly resident wages, which crossed $8,000 last year, and to help middle-income Singaporeans save more for retirement.

a. Some Members have expressed concerns that the increase in the ceiling will add to business costs for employers, and reduce the take-home pay of middle-income workers.

b. I understand these concerns. But I also hope Members appreciate that the move will, in fact, benefit workers. Because they will have more CPF savings, which can be used for healthcare and housing, and importantly, they will be able to save more and strengthen their retirement security in the longer term.

c. We are phasing in this increase over four years because we have consulted our tripartite partners, and engaged them and listened to their concerns. And we know that we need to do this over a period of time to give our employers and employees time to adjust. The annual salary ceiling will also remain unchanged at this juncture, which was also part of the considerations during consultations, and this will limit the impact on business costs.

129. Beyond the moves in this Budget, we are undertaking a review of our CPF system parameters and retirement policies, including the Silver Support Scheme. Our aim is to assure all Singaporeans that as long as they work and contribute consistently to their CPF, they will be able to meet basic retirement sum. And for those who do not have the ability to work, or the runway to work and save through CPF, we will find other ways to ensure their retirement security.

130. We are also looking at the long-term care arrangements for our seniors, something which many Members spoke about. Many were concerned over the affordability of the care options, and the increasing burden of care on our caregivers.

131. In this regard, some have suggested providing more support for caregivers. Indeed, we had earlier announced the enhancement of the Home Caregiving Grant, and the enhanced grant will take effect next month.

132. But we are not looking at caregiving support alone; we have to review more broadly our aged care system to see how we can enhance the care and living options for seniors within our community, while ensuring that our long-term care services remain affordable.

a. So we are looking at various things, including developing more senior living options in our housing estates; how we can best deploy and operate our Active Ageing Centres, something I spoke about in the Budget Statement; and beyond the hardware and infrastructure, how we can provide a more seamless continuum of care for our seniors, with easily accessible and integrated services across all neighbourhoods.

b. It is challenging, as the aged care sector is extremely complex and highly fragmented. So we will need to think through our plans carefully, and consider how best to deploy limited resources – both land and manpower, in efficient and sensible ways.

133. And Sir, this has always been our approach to providing assurance for our people. We review our policies carefully, we ensure that any long-term or permanent programmes are sustainable and reinforce the ethos of self-reliance and mutual support, and that’s how we have progressively strengthened our social security system and safety nets, and implemented schemes like Workfare, CPF LIFE, and Silver Support.

134. Mr Deputy Speaker, I have covered a few key areas where we are looking to do more to uplift vulnerable groups and support our seniors. But as I said in the Budget speech, the moves in this Budget are part of a broader review to strengthen our social compact. And many Members gave very good suggestions in this Debate.

a. Ms Yeo Wan Ling shared ideas on how to better support gig and self-employed workers.

b. Dr Wan Rizal, Ms Nadia Samdin, and Mr Melvin Yong spoke about those with mental health needs or conditions.

c. Ms Cheng Li Hui, Mr Darryl David, and Mr Eric Chua spoke about how we can make Singapore more family-friendly.

d. Mr Don Wee, Dr Shahira Abdullah, Ms He Ting Ru, Mr Louis Ng, and Ms Rachel Ong have highlighted other groups who need help, such as persons with disabilities and their caregivers, students with special needs, healthcare workers, and single parents.

e. We are reviewing all these and many other areas as part of Forward Singapore.

f. In the coming months, the 4G team and I will study the various suggestions provided, and partner Singaporeans to develop new strategies and impactful solutions.

E. Taking Care Of Present And Future Generations

135. Sir, taking care of one another is not just about meeting the needs of today; it’s about looking after our children, grandchildren, and future generations to come. We must do what is right for today, and for tomorrow.

136. That is the approach our forefathers took.

- a. In the earlier decades when our economy took off and grew rapidly, they did not just spend all the surpluses, without any regard for the future.

- b. Instead, they painstakingly built up the reserves.

- c. And they introduced the Elected Presidency to safeguard and protect our reserves.

137. Now, these values of discipline, prudence, and the willingness to sacrifice for the next generation are the very essence of what undergirds our framework for the reserves.

138. And looking after future generations does not mean we are neglecting the current generation. Far from it. You know, sometimes we talk about the future as if it’s some distant thing many years away.

a. But in fact, the so-called “future generations” are really not very far away.

b. Many in this Chamber will still be alive 20 or 30 years from now. Professor Koh shared his hopes to be in Singapore in 2050 as a retired professor, looking at how green Singapore will be. I certainly hope to be there at that time too.

c. Our children will certainly be growing up in that timeframe, and will be directly impacted by what we do today. So, the future is not something abstract, you know, something that’s not linked to us. It’s us and our children.

139. In any case, all of us today are currently benefiting from the reserves. Our reserves are our endowment fund and our rainy-day fund.

a. As our endowment fund – the returns from our reserves have enabled us to keep overall tax burden light, as I’ve shown just now. And out of every dollar we spend in our annual Budget, 20 cents come from the NIRC.

b. It is our rainy-day fund – and we saw both during the Global Financial Crisis and over the past three years, how our reserves helped us to weather crises without having to incur debt that future generations will have to pay.

140. So, what we enjoy today must never be taken for granted. And many Members highlighted this, including Ms Foo Mee Har, Dr Lim Wee Kiak, Ms Poh Li San, Ms Joan Pereira, and Mr Shawn Huang. And as they highlighted, we will have to brace ourselves for all sorts of possible disruptions and shocks in this new world, and we have to do more to strengthen our national resilience.

141. Take pandemics as an example. We had SARS in 2003, and then COVID-19 almost 20 years later in 2020. We may not need to wait another 20 years before we face the prospect of another deadly and devastating pandemic in the world.

142. We face global warming and the growing threat of climate-related disasters. And climate risks can also lead to other risks. It can disrupt global food supplies. It can facilitate the spread of more illnesses and pandemics.

143. We now have superpower rivalry between China and the US, and potential flashpoints in the region. The superpowers are now thinking in terms of “spheres of influence”,1 so smaller countries like Singapore will come under growing pressure.

a. We have enjoyed peace and stability in the region for close to 50 years since the end of the Vietnam War.

b. It’s hard for us to imagine things how things could be different.

c. But look at Ukraine and Europe and how the situation changed so quickly.

d. With growing geopolitical tensions, can we be sure that our region will be able to avoid conflict in the coming decades?

e. And if there were to be a conflict or a hot war in this part of the world, how will that impact Singapore?

144. These are major risks that we will have to consider and take seriously. And given these plausible scenarios of the future, what should our response be?

a. To blithely spend more from the reserves, as the Opposition proposes, because we are just slowing down the growth rate as they claim?

b. Or to husband our reserves, and uphold the principles that underpin the protection of our reserves that have served us well all these years?

145. To me, the answer is clear.

146. In fact, you know, I would say there appeared to be a time when the Workers’ Party seemed to me, to share the Government’s perspective on the reserves.

a. Because in 2009, when this Parliament debated whether to draw $4.9 billion of Past Reserves that year to help Singaporeans tide over the Global Financial Crisis, Mr Low Thia Khiang, then from the Workers’ Party, expressed “surprise” at the need to do so.

b. Mr Low said, and I quote, “Past Reserves are a strategic asset meant for use in times of need, especially when the Government faces financial constraints due to unprecedented circumstances which require the Government to respond in the interest of the nation”. I could not have said it better.

c. Later in 2011, after we recovered well from the crisis, we were able to put back into Past Reserves what we had drawn earlier, and Mr Low applauded this move. He said in his speech in Parliament that this was “one thing right” that the Government had done in the Budget that year. Many things were not right, but that one thing was done right.

147. Now, this time, I explained in the Budget Statement that we are highly unlikely to put back the $40 billion drawn from Past Reserves.

a. Several PAP MPs like Mr Liang Eng Hwa, Mr Zhulkarnain, Ms Tin Pei Ling have, over this and the recent Budgets, emphasised the importance of fiscal discipline, and urged the Government to try to put back the money into Past Reserves, should our fiscal position improve.

b. But the Workers’ Party has been completely silent on this.

c. Instead, their repeated calls for the Government have been to spend more from the reserves – to slow the growth of the reserves, increase the 50% NIRC formula, change the reserve rules – different options, different suggestions, dressed up in multiple ways, but it boils down to the same consistent ask.

d. And it sounds to me that the Workers’ Party has shifted its position since the days of Mr Low.

148. But in the end, Singaporeans will have to judge what is the more responsible approach to manage our finances, and to take Singapore forward.

a. I say, let’s uphold the values of our forefathers, and do what is right by past, present, and future generations of Singaporeans.

b. Let’s maintain a strong fiscal foundation so that Singapore can continue to prosper and thrive for many more years in this troubled world.

F. Conclusion

149. To conclude, Mr Deputy Speaker, the Budget is not just about dollars and cents. Neither is it about winners and losers, or about “pitting the well-off against the rest of society”. Instead, it reflects our values as a people, and our unwavering commitment to build a fairer, more inclusive, and ever more just society.

150. In his opening remarks, Mr Pritam Singh gave an impassioned speech – that we must not allow “two Singapores” to emerge. This has in fact been the PAP Government’s steadfast approach all these years; so I thank him for agreeing with what we are doing.

151. But I must say I find it a bit odd how Mr Singh characterises the “two Singapores”. In particular, he suggested that if you are unable to upgrade to a condominium or a landed property, or own a car, you will be in the second Singapore. But the test of social mobility cannot be about owning a landed property or purchasing a car.

152. Let’s not perpetuate such narrow definitions of success. The fact is everyone will have their own aspirations and passions to pursue. Ultimately, we aim to value and celebrate every individual for who they are, and to provide them with opportunities to do better throughout their lives. That’s how we will refresh and strengthen our social compact.

153. I also agree with Mr Singh’s remarks that fiscal redistribution should not be about pitting one group against another. And I am very glad that the WP supports the Budget this year, even though it includes the second step of the GST rate increase.

154. But the irony is this: the Workers’ Party shares the Government’s view that those who earn more should pay more in taxes; yet it consistently refuses to acknowledge the unique way the PAP Government has implemented our GST system, which requires the well-off to contribute more, and does not hurt the poor.

155. And I can’t help but feel that it’s because the WP thinks that there is political mileage perhaps in pushing for ideas to soak the rich, and maybe political advantage to reject the GST, despite everything we have done to implement it in a way that is fair, and that doesn’t hurt the poor.

156. Sir, governing Singapore cannot just be about scoring political points, or doing what is politically convenient or expedient. We have to do what is right for Singapore and Singaporeans. And when tough calls like raising the GST have to be made, we have to be upfront, explain our position, and persuade Singaporeans why such painful decisions are necessary, but will ultimately benefit everyone. This is what the PAP Government, and successive PAP Ministers for Finance have done.

157. In the end, I have faith in Singapore and Singaporeans. We are a rugged and resilient people. We know what it means to live within our means, earn our own keep, and stand on our own feet with dignity and pride. We are also a caring and big-hearted people. We care for the people around us; we care about our children and grandchildren, and our future generations yet to be born. We rally together through thick and thin, and we move forward as one people. We will never mortgage the future of our children and future generations, but will do everything we can to give them a better start in their lifetimes.

158. Our solidarity and our values are our deepest strength. They are what make Singapore work. They have kept Singapore going, through good years and bad. And they will enable us to secure our prospects and build a better future together, as one united people, and one Singapore.

Footnotes

1 “Thinking in terms of “spheres of influence” is back in fashion”, The Straits Times, 22 Feb 2023.

RELATED

Other related content that might interest you